Adaptation

Monday, April 1st, 2020

That is the name of the game. We are all having to adapt to what’s being dubbed the ‘‘new normal.’’ Those who are able are practicing ‘‘WFH’’ or Work From Home days and sharing Wi-Fi access with their children who are completing their school year via online learning. Children are very adaptable and resilient, and it appears they are also resilient to the Coronavirus. Being adaptable is critical to survival. As an example, there are species of frogs that can actually change their sex if the percentage of males and females becomes unbalanced in order to ensure the species will survive. While we are far from that, this virus does appear to be changing certain demographics.

As Americans, we have had to adapt the definition of freedom. Freedom to travel, freedom to gather, freedom to hit the gym, and freedom to buy more than 3 bags of pasta have all been taken from us. We will get through this, and once again American strength and ingenuity will persevere. Everyone is having to adjust their routines and the ways in which we live. Restaurants have moved to delivery, curbside, and to-go overnight, with waiters turned drivers in an attempt to keep staff employed. School districts have adapted school buses from student transportation to meal delivery vehicles for low income students stuck at a home. Convention centers, hotels, and cruise ships are adapting into makeshift hospitals to combat the virus. During this lockdown, I have personally taken it upon myself to help support our local restaurants and have been ordering out as much as I can. Unfortunately, while I sit here typing and eating my yummy brisket grilled cheese sandwich, I realize I might be adapting to a larger waistline.

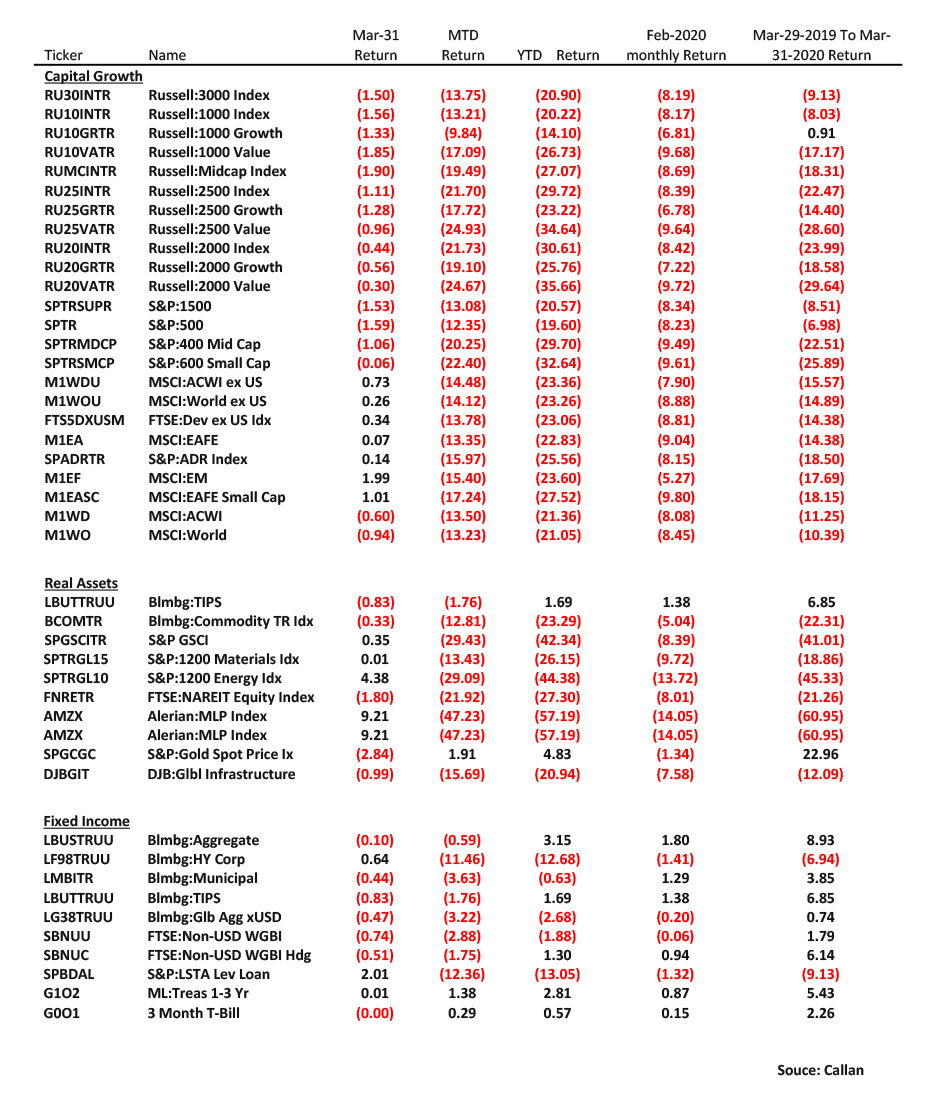

The stock market is adapting to ever-changing data, expectations of how deep and long a recession will be, and the on again, off again fiscal response from Congress. Moreover, the Fed is adapting daily to issues in the bond market and providing massive amounts of liquidity and support to calm and normalize trading. This support has been critical to bring order back to the markets, where spreads in high quality instruments have gapped out to historical levels (sending bond prices down), due to massive selling and unwinding of portfolios.

While most investors hold bonds for safety and income, they are having to adapt to the fact that traditional bonds can actually be volatile and provide little income at current rates. As a firm, we are adapting our income generation strategies, as in this ‘‘balanced bear’’ market, a 60/40 portfolio loses on both equities and bonds. Private credit markets adapted after 2008 when the banking industry collapsed, and regulations made lending more difficult. These non-bank—–banks filled the gaps of many lending needs and provided better yields than the traditional fixed income marketplace.

While this sell-off has been painful, we do believe a bottoming is near and recovery is on the horizon. Whether that is a “U” a “V”, an “L” or a “W” recovery remains to be seen, but we will recover. Despite social distancing, this pandemic is bringing us together as a nation. Private and public industry collaboration is working to bring about a vaccine, and corporate America is jumping in by converting their manufacturing plants to accommodate the production of masks and ventilators. Americans are committed to flattening the curve and getting us through this difficult period as quickly as possible. As with any crisis, fear is heightened. It’s times like these that we have to remind ourselves that the sky has never fallen. This too will pass, the stars will come out, and the sun will shine again.

Regards,

John P. Ulrich, CFP®

President

Whitney E. Solcher, CFA®

Chief Investment Officer