Hurry Up and Wait

Thursday, September 30th, 2021

While 2020 was consumed by the ‘‘C’’ word (as in COVID) along with other expletives, 2021 seems to be associated with the ‘‘I’’ word, and I don’t mean ‘‘Inclusion.’’ The bad word as of late is ‘‘Inflation’’, and it’s on the tips of everyone’s tongues, from the nightly news to your local butcher. No matter where you turn, one cannot escape from the subject matter or hide from the word ‘‘transitory.’’ Even Nicki Minaj, a famous Trinidadian-born rapper, singer and songwriter has been tweeting about inflated ‘‘assets.’’ If you haven’t heard, I suggest you Google it!

So, what exactly is the definition of inflation you may ask? In short, too many dollars chasing too few goods…and these days, those goods are called reservations! The world has re-opened and patrons are hungry for dining anywhere but their own home. The Washington Post’s recent article, ‘‘What are Americans making for dinner? Reservations’’ was aptly titled for the wave of pent-up vaccinated masses eager to satiate their growing appetites. ‘‘I can’t get a reservation!’’ is often overheard from friends and passerby’s who I see frequently denied entry at local establishments. Some of the angst is due to limited capacity; however, the larger factor at play is workers, or should I say lack thereof. It seems hourly wages and tips are having a hard time keeping up with Uncle Sam’s generosity and in some cases, workers have just moved on to find other positions that offer more stability and/or flexible schedules, which many people have grown accustomed to during their COVID quarantine.

From LA to Las Vegas to New York City, staff is in short supply and same day cash payment and bonuses are proving to be little incentive. Small resort towns where labor tends to be seasonal, such as Aspen and Jackson Hole, are having an even tougher time as restaurants are forced to limit days and hours of the week when they are open. Combine that with reduced flight capacity, limited beverage service, poor timetables, and hostile passengers and it all adds up to the vacation blues for Summer travelers…and don’t even get me started on rental cars! Word to the wise, do not travel without a reservation, and when in doubt a staycation may still be your best bet.

I recently patronized a well-loved local bar and grill that serves, well…bar food. While they can generally whip out a burger in 8-10 minutes, they struggled to produce my meal in an hour. I could only spot two front of house staff; however, the kitchen seemed to be rocking; pumping out order after order, all of which were packed in…wait for it…To Go boxes. It seems some establishments are hedging their bets and deciding not to turn their backs on the takeout business that kept them afloat over the last eighteen months. In addition, they may be struggling to get the appropriate balance of staff to return to operations as normal. I don’t like to admit that I sometimes crave a McDonald’s sausage egg McMuffin, but on my last visit I received a short-form job application with my order. Just another sign of the employment conundrum.

Hurry up and wait isn’t just at restaurants either. While I am more of an online shopper myself, a recent errand forced me to go to the mall. I observed countless storefronts with

lines out front, restricting the number of shoppers inside. Bewildered, I stood and stared, wondering if there was a run on underwear or hand bags. Nope, the lines were not due to

lack of clothing rather a lack of employees to man the tills. Even Dollar General has announced raising prices on certain goods over $1, given rising shipping costs due to lack of

containers. ‘‘Too few goods’’ has become synonymous with employees and capacity!

They say that what comes up must come down, and the cure for high prices is high prices. So, is this inflation transitory? We think it is, but it depends on your definition of transitory.

We’ve already seen lumber prices come back down. Why? Builders stopped building, and people delayed their home improvement plans just when DIY was getting popular. Used cars have also finally plateaued, as consumers have decided their current ride has a few more clicks on the odometer. If you want something bad enough, simply wait, patience is a virtue. After all, what’s a year or two after a global pandemic? It’s called transitory, and just like a virus, inflation has to run its course.

Despite the rumblings of inflation, what history has shown is that while global pandemics may experience price and employment shocks, they are generally deflationary. Not only to the hearts of people who lost loved ones but to the economy itself. We have not yet felt the full effect of losing 4.8 million people nor the aftershocks of those suffering from long-COVID and the drain that might cause on governments and healthcare systems. Indeed, we are definitely in a mini-cycle as supply chains get back on track and demand normalizes; however, larger disinflationary pressures are still at work from lower birth rates, reduced immigration, reduction in labor participation (COVID accelerated retirement), increased savings, and continued technological advances.

The alternative argument, is maybe this time is different? Past pandemics have never experienced such a massive global response or benefitted from the sheer speed of

information and biomedical innovation. Governments have engaged in unprecedented fiscal and monetary stimulus to prevent costly lay-offs and bankruptcies and provided much needed liquidity to the credit markets. These policies have likely alleviated the adverse economic effects of the pandemic and may lead to a rise in (headline) inflation if maintained beyond the health crisis.

The key determinant of lasting pricing pressure is inflation expectations, and while consumer fears may be elevated (and rightfully so), the bond market (as referenced by the 5-year TIPS break-even rate) is currently pricing in 2.5%, modestly higher than the 1.8% historic trend since 2003. Time will tell if the COVID-19 trend inflation, will indeed be different this time around.

Closing Thoughts

Perhaps the most dangerous form of inflation is inflated expectations for future returns. Given the significant run-up in US equities over the last several years, we cannot in good

conscience project that to continue and neither do our capital markets forecasts. Diversification is key and a thoughtful strategic allocation must not be transitory to be

successful. At Ulrich, we focus on long-term goals and have tactically shifted our client portfolios to benefit from cyclical equity drivers, increased commodity and real asset prices, and income generating investments. While the US has led the expansion, we do foresee a more synchronized global recovery going forward. Fits and starts are expected, along with continued volatility into year-end, due to potential tax reform, aggressive and uncertain Chinese regulations, and the unknown prospects of another COVID variant. At Ulrich, we pride ourselves on preparing our clients’ portfolios for the known and unknown.

Regards,

John P. Ulrich, CFP®

President

Whitney E. Solcher, CFA®

Chief Investment Officer

Equity Markets

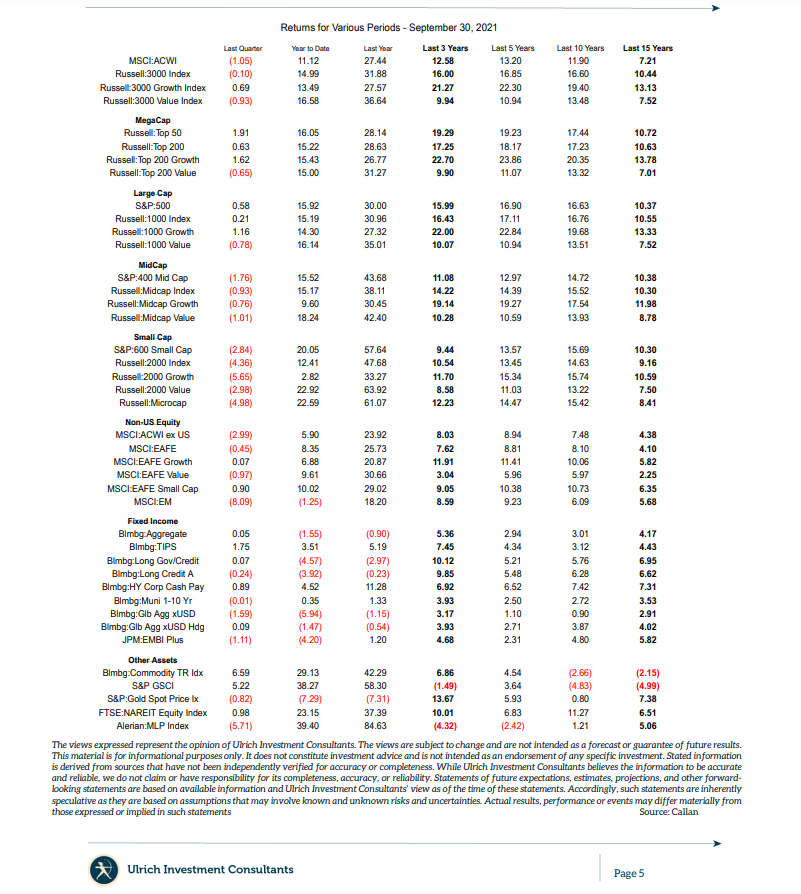

The S&P 500 Index was up a modest 0.6% in 3Q with results mixed across sectors. Industrials (-4.2%) and Materials (-3.5%) were at the bottom of the pack while Financials (+2.7%) were the best performers. Since the market low in February 2020, the S&P is up 97.3%. Growth stocks outperformed value (R1000 Growth: +1.2%; R1000 Value: -0.8%) but lag for the YTD period (+14.3% vs. +16.1%). Small cap stocks underperformed (R2000: -4.4% vs. R1000: +0.2%) and now lag YTD (12.4% vs. 15.2%).

The MSCI ACWI ex-USA Index lost 3.0% for the quarter, hurt primarily by U.S. dollar strength and the benchmark’s exposure to emerging markets. The best-performing sector was Energy (+7%), while Consumer Discretionary (-11%) and Communication Services (-10%) posted steep declines. Note that these sectors include some of the Chinese stocks that have been hit hard by the country’s regulatory crackdown (Alibaba, Tencent, and Baidu). The MSCI EAFE Index (Europe, Australia, and Far East) lost 0.4% but in local terms it was up 1.3%. Japan (+4.6%) performed relatively well while many of the larger constituents were down for the quarter. The MSCI Emerging Markets Index sank 8.1%, making it the worst-performing asset class for the quarter. Within emerging markets, Brazil (-20%), China (-18%), and Korea (-13%) fell sharply while India (+13%), Russia (+10%), and Colombia (+10%) were up strongly.

Fixed Income Markets Yields in the U.S. were relatively unchanged from 6/30/21, masking intra-quarter volatility. The 10-year U.S. Treasury closed the quarter at 1.52%, up sharply from early August when it traded at 1.19%. TIPS outperformed nominal Treasuries for the quarter (Bloomberg US TIPS Index: +1.8%; Bloomberg US Treasury Index: +0.1%). The Bloomberg US Aggregate Bond Index returned 0.1% but remains down 1.6% YTD. Lower quality continued to outperform. The Bloomberg High Yield Index rose 0.9% and leveraged loans (S&P LSTA Lev Loan: +1.1%) also performed well. Municipals (Bloomberg Municipal Bond Index: -0.3%) underperformed Treasuries for the quarter. Overseas developed market returns were similarly muted, and U.S. dollar strength eroded returns for unhedged U.S. investors. The Bloomberg Global Aggregate ex-US Bond Index fell 1.6% but was flat (+0.1%) on a hedged basis. Emerging market debt posted negative returns; the JPM EMBI Global Diversified Index fell 0.7% and the local JPM GBI-EM Global Diversified Index lost 3.1%, most of which was due to currency depreciation. In local terms, this Index was down only 0.2% for the quarter.

Real Assets

The Bloomberg Commodity Index rose 6.6% for the quarter and is up 29.1% YTD, but what lies under the hood is more interesting. Natural gas prices soared nearly 60% for the quarter, and those gains were relatively muted compared to the experience in Europe, where prices tripled over the quarter. WTI Crude Oil was up 4%. TIPS (Bloomberg TIPS Index: +1.8%) performed well relative to nominal U.S. Treasuries. Several other sectors were essentially flat for the quarter; the MSCI US REIT Index gained 1.0%; gold (S&P Gold Spot Price Index: -0.8%) and infrastructure (DJB Global Infrastructure: -0.9%) fell slightly. Copper fell more than 4% on worries over slowing demand from China.